Wolfden Releases Positive Deep Survey Results at Rockland in Nevada

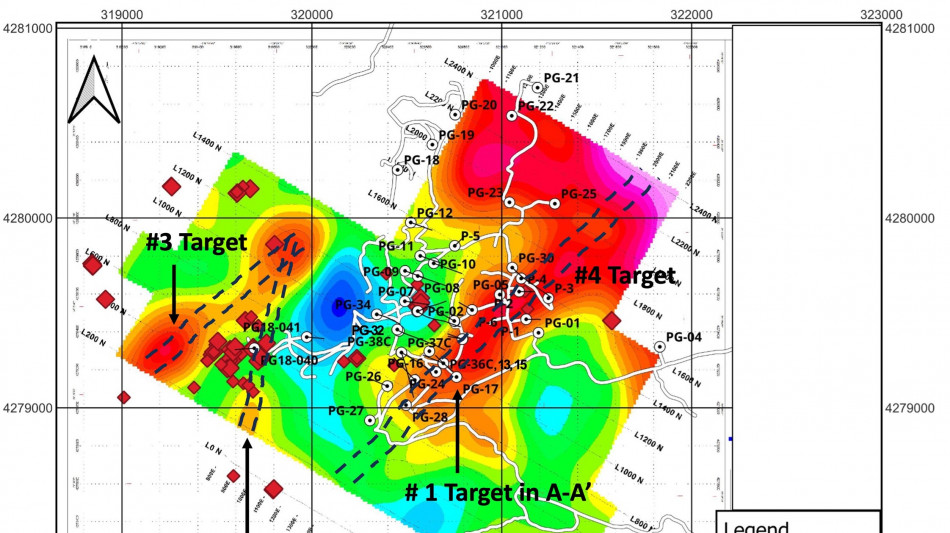

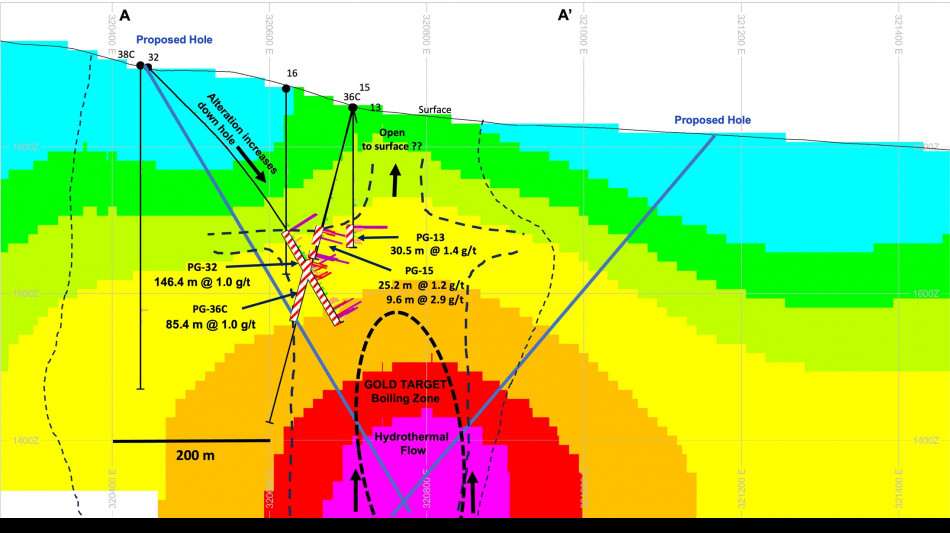

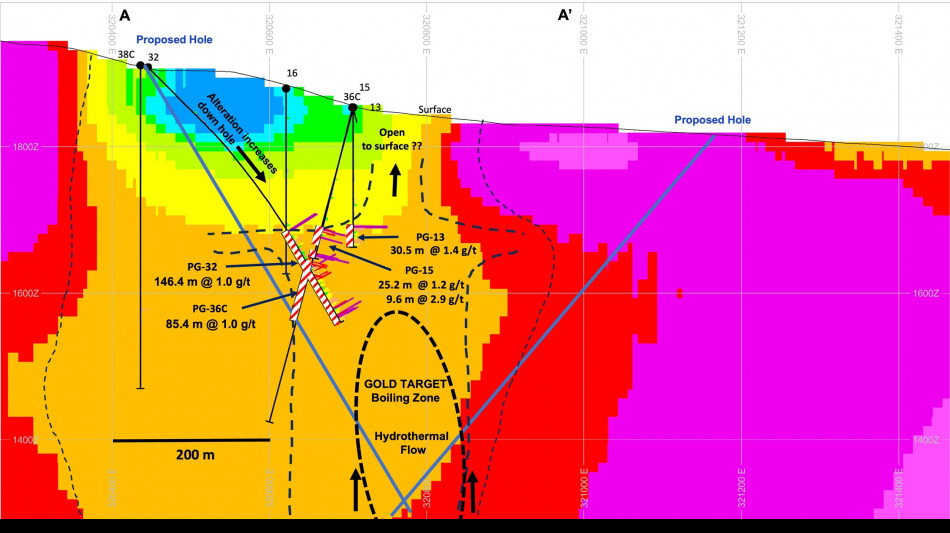

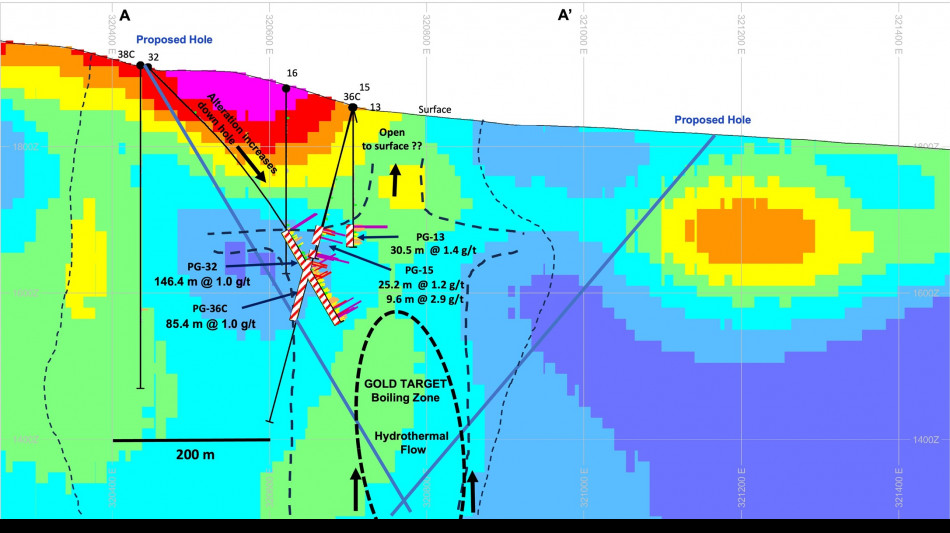

TORONTO, ON / ACCESS Newswire / June 3, 2025 / Wolfden Resources Corporation (WLF.V) ("Wolfden"or the"Company")is pleased to release positive results from a recent deep penetrating induced polarization (IP) geophysical survey from its Rockland Gold Project located in the Walker Lane Trend of Nevada, USA. The survey was designed to test for anomalous chargeability just below historical drill results that ended in mineralization with 146.4 metres at 1.0 g/t AuEq* in hole PG-32 and hole PG-36C drilling in the opposing direction 70 metres away with 85.4 metres at 1.0 g/t AuEq* (see Figures 3 to 5). Importantly, these holes both include intervals of higher grades and alteration that increases in intensity with depth, both indicative of a potential higher grade system at depth. A 3D inversion model of the IP survey results indicates a stronger chargeability anomaly below the altered rhyolite-hosted lower grade gold mineralization closer to surface. In addition, the anomaly is coincident with a northeast-trending structural corridor that is interpreted to extend at least 1.7 km (1.1 miles) below other positive gold bearing drill hole results and altered rhyolite domes. The Company believes that the chargeability anomaly indicates an increase in disseminated pyrite from hydrothermal-alteration, which correlates well with the gold mineralization observed along the trend. Banded quartz veins and quartz-enriched zones within the pyrite-alteration of the historic drill holes have returned elevated gold values. The Company is targeting just below the historic drilling where potential boiling occurred in the hydrothermal system that could lead to increased pyrite mineralization and higher grades. The IP survey and the previous CSAMT survey have now clearly defined similar sizable corridors that warrant testing at depth. The Company plans to commence a drill program in July to test these targets.

The 1,800 metre drill program is permitted and funding is available from the Company's recent US$1.5M land sale in Maine pending final approvals from the TSXV that is expected in the coming weeks. An analogous target model is AngloGold's major new Silicon-Merlin discovery located in the Beatty Mining District further to the southeast along the Walker Lane trend, which hosts Indicated-level mineral resources of 121 mT for 3.4 million ounces of gold and Inferred mineral resources of 391 mT for 12.9 million ounces of gold1.

"The Rockland East target in our opinion represents one of the most exciting drill ready exploration targets in the Walker Lane Trend as it consists of 1) potential large gold system with material as supported by gold intercepts in two opposing holes 70 metres apart, that both returned 1.0 g/t AuEq* over 85.4 metres and 146.4 metres, the latter ending in gold mineralization, 2) new deep IP results suggesting that hydrothermal fluids upwelled and ponded, creating wide, lower grade gold mineralization that could flank a pyrite-rich, higher-grade gold vein system at depth, 3) an historic high grade Au-Ag vein mine which is part of the property package further to the west of the survey area shows that high grade gold zones occur on the property and, 4) multi-square kilometre scale, argillic to advanced argillic, rhyolite and basin-margin-debris-hosted alteration zones that are cut by quartz veins enriched in antimony, arsenic and gold," stated Don Dudek, Senior Exploration Advisor for Wolfden. "These are the typical characteristics exhibited by some of the high quality gold deposits in the Walker Lane Trend."

As per the terms of the earn-in agreement with Evergold Corp. (EVER.V) and the underlying claim owner ("Owner"), who are both at arm's length, Wolfden must complete US$1.175 million in exploration expenditures, including a minimum of 5,000 feet (~1,500 m) of drilling in 2025, and make cash payments of up to US$600,000 over a period of three years to earn a 51% interest in the property by March 2028. The first cash payment of US$100,000 was paid in March, 2025. Upon completion of these terms, Evergold will have earned a 100% interest in the property from the Owner less a 3% NSR of which 2% can be repurchased for US$3 million and the property title will transfer from the Owner to Wolfden. At such time, Wolfden may elect to 1) continue to earn a 75% joint venture interest in the Project by funding up to the completion a Pre-feasibility Study within 5 to 8 years or 2) elect to continue as the operator of a joint venture with its initial 51% interest. In either scenario, if Evergold is ever diluted to a 20% interest or less, it will convert its interest to a 2% NSR where Wolfden can repurchase 1.5% from Evergold for C$2.25 million. Under either election, all NSR buyback rights and first rights of refusal to purchase all interests and NSR's shall apply and be held by Wolfden and or the joint venture.

The earn-in agreement was announced on October 29, 2024 and is considered a fundamental acquisition for the Company, as defined in Policy 5.3, and as such is subject to certain conditions having been met under Section 5.7 of Policy 5.3, including the review by the TSX Venture Exchange of a technical report prepared in compliance with National Instrument 43-101 (Standards of Mineral Disclosure) that was submitted in May.

Technical Details

The IP survey was carried out in April, 2025. It was designed to penetrate to 400 metres below the surface which is well beyond the previous IP survey and below hole PG-32 that ended in gold-bearing disseminated pyrite mineralization, but still above where both the boiling zone of the hydrothermal system, where higher gold grades are interpreted to occur. This new IP survey was expanded from the previously surveyed area to investigate newly interpreted disseminated sulphide zones and provide insight into the relationship between increased chargeability and coincident CSAMT anomalies (controlled source audio magnetic telluric).

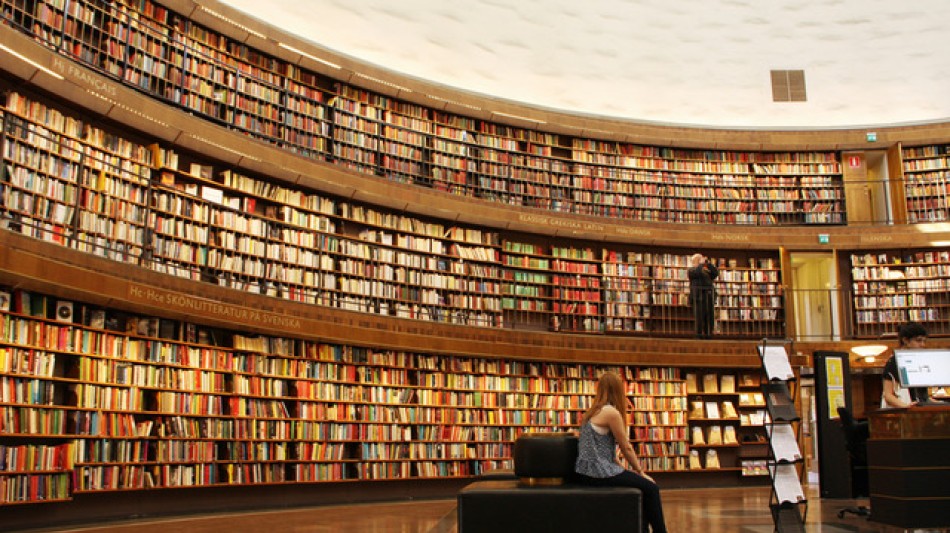

The IP survey indicates that there is a 1.7 km long ridge of higher chargeability that is related to the area where historic drill holes returned gold values (Figures 2 and 3). A CSAMT, resistivity high correlates with at least 50% of the IP trend as does the IP resistivity, which also correlates with the chargeability. The resistivity highs are interpreted to be related to silicification which appears be related to gold mineralization. Figure 3, also shows proposed drill holes with one hole to test down dip of the intercept in Hole PG-32 and another hole, if warranted, to cover the rest of coincident chargeability and resistivity trends. Figures 3 to 5, also presents an intercept in hole PG-36C of 1.0 g/t AuEq over 85.4 metres. This intercept, and the one in PG-32, are 70 metres apart at their closest point, which suggests that there is a decent volume potential of ~ 1 g/t AuEq mineralization, and that may also extend further to surface.

The IP survey also picked up a new, 1.2 km, northeast-trending chargeability anomaly in the northwest part of the survey area (Figure 2). Approximately 50% of the anomaly (west half) correlates with a weak resistivity high. In addition, 34 grab samples, collected down-slope of the IP anomaly, returned from 0.24 to 30.3 g/t Au and until this survey was completed, a possible source of these mineralized boulders had not been located. It is evident that that a nearby hole would have missed testing the chargeability anomaly. This target cannot not be tested in the current program as a new work permit is required.

A third weaker chargeability anomaly occurs just south of the above anomaly (Figure 2). This area is one of the priority targets as it is testing a new target area along a northerly trending CSAMT anomaly, a strong interpreted structure, a structural splay feature and highly anomalous arsenic, antimony and silver, in nearby holes.

The high chargeability in the northeast part of the survey grid is likely related to the combined effect of conductive sediments and the altered volcanics with the sediment response overwhelming the chargeability response of the altered rhyolites. Strongly altered rhyolites have been mapped to the 2nd line to the northeast; however metal chemistry indicates that these altered rhyolites are more distal from the core of a mineralized system than the rocks to the west of this area.

QA/QC Comment

All grades over drilled length were calculated from a validated drill database that includes work from several different companies. Holes 13 to 27 were completed in 1995 by a well-known international company and although there is no QA/QC documentation available, it is assumed that the work and the laboratory used would have been of good industry standards and practices.

Holes 30 to 38C were drilled in 2006 and 2007 with a complete QA/QC program that included reverse circulation samples of 9 kilograms on average, collected at five-foot intervals from a wet splitter. Occasional duplicate samples were taken in the same way. Control samples including standard pulps and crushed marble blanks were inserted into the sample sequence about one every 10 samples. The samples were prepared and fire assayed for gold and multi-element analysis by ALS Chemex at their laboratory in Sparks, Nevada. All drill core was HQ in size, photographed, logged, including RQD measurements and recovery, prior to sampling. Sample intervals were typically chosen to follow actual core block/run intervals to a maximum of five feet of sample. Control samples including standard pulps and crushed marble blanks were inserted randomly in the sample number sequence to check and verify lab accuracy. The control samples were inserted at least one every tenth sample and more frequently in well mineralized zones.

The grab samples were collected by at least four different exploration teams, including those that had completed the drilling. It is believed that the prospecting grab sample data noted in this release, accurately reflect the gold content of the rocks, especially since different groups returned anomalous assays from the same area and that at least one of the groups, had an active, documented drill sample QAQC program in 2006 and 2007.

About Wolfden

Wolfden is a North American exploration and development company focused on high-margin metallic mineral deposits including precious, base, and critical metals. It has two nickel sulphide deposits in Manitoba and one of the highest-grade polymetallic projects in the USA (Zn, Pb, Cu, Ag, Au) that represent significant development projects with the potential to produce domestic supply of strategic metals.

For further information please contact Ron Little, President & CEO at (807) 624-1136.

The information in this news release has been reviewed and approved by Ron Little, P.Eng., President and CEO, who is a Qualified Persons under National Instrument 43-101.

* True widths unknown. Calculation of AuEq uses gold price of US$2000/oz and silver price of US$25/oz. The gold to silver ratio is approximately 9:1.

1 Silicon/Merlin discovery- meant only as a target comparison and not to imply that future work at Rockland will return similar results

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events, including the potential for projects to be domestic sources of ethically produced base and critical metals for the expansion of renewable energy in North America. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, metal price assumptions, cash flow forecasts, permitting, land transactions, community and other regulatory approvals, and the timing and completion of exploration programs in the USA, Manitoba, New Brunswick and the respective drill results. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1. Rockland Property Location Map

Figure 2. Rockland Chargeability Plan Map at a vertical depth of 200 m below surface including gold-bearing surface grab samples

Figure 3. Rockland Chargeability Cross Section A-A' including hole PG-32 that stopped short of the new target

Figure 4. Rockland Resistivity Cross Section A-A' including hole PG-32

Figure 5. Rockland CSAMT Survey Section A-A' including hole PG-32

SOURCE: Wolfden Resources Corp.

View the original press release on ACCESS Newswire

H.Bastin--RTC