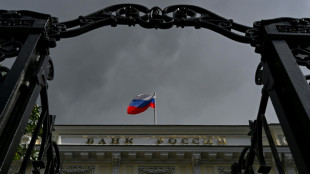

IMF gold sales among measures to tackle debt, says report for G20

South African President Cyril Ramaphosa welcomed Tuesday a G20-commissioned report proposing the sale of some of the IMF's "hoard of gold" and a review of lending practices among measures to tackle Africa's crippling debt.

The proposals were included in an expert study commissioned for the first G20 summit in Africa which will bring around 20 heads of state to Johannesburg this weekend.

"Globally, more than 3.4 billion people live in countries which spend more on servicing debt than on education or healthcare," said the document handed to Ramaphosa.

"Governments are literally defaulting on development in order to honour their debt obligations," it said, citing figures that public debt in developing countries surpassed $31 trillion in 2024.

The G20 should work with the IMF and the World Bank to create a debt refinancing scheme for low-income and vulnerable countries, the report said.

One way would be to sell some of the tens of millions of ounces of gold held by the IMF, said the head of the Africa Expert Panel, former South Africa finance minister Trevor Manuel.

This gold was held at its historic price of $50 an ounce even though the metal currently sold for more than $4,000 an ounce on the market, he said.

The call is for the creation of a transparent mechanism for the sale of some of this resource to fund countries in debt distress, Manuel said.

"There's a lot of detail that can and should be worked out, but it's a solution staring us in the face that doesn't have to cost money," he said.

"It's good to hear... that there is a hoard of gold in the IMF," Ramaphosa said after accepting the report.

"This is the type of resource that can be made available to deal in part to either guaranteeing, financing the debt of many countries in the Global South," he said.

Ramaphosa also welcomed proposals for a "Borrowers' Club" of lenders to share best practices and for a review of IMF and World Bank lending frameworks.

The report also urges credit rating agencies to reveal the metrics they use to assess risk, with some concern they may be unfairly discriminating against African countries.

South Africa is currently holding the rotating presidency of the Group of 20 leading economies which meets annually to discuss issues of global growth, development and financial stability.

C.P.Wilson--RTC