National Capital Bancorp, Inc. Reports First Quarter Earnings and Quarterly Cash Dividend

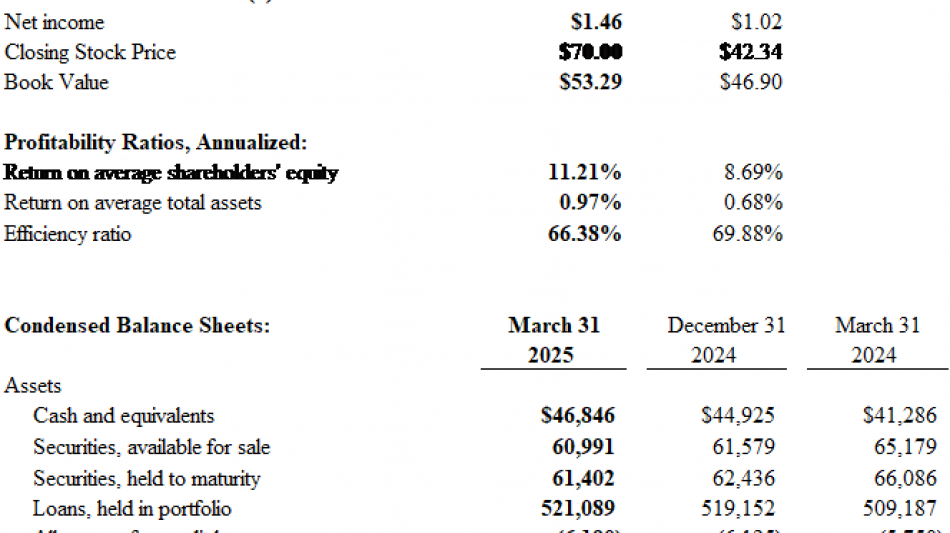

WASHINGTON, D.C. / ACCESS Newswire / April 30, 2025 / National Capital Bancorp, Inc. (the "Company") (OTC Pink:NACB), the holding company for The National Capital Bank of Washington ("NCB" or the "Bank") reported net income of $1,673,000, or $1.46 per common share, for the three months ended March 31, 2025, compared to net income of $1,170,000 or $1.02 per common share, for the quarter ended March 31, 2024. Earnings per share, cash dividends per share and average shares outstanding have been adjusted to reflect the November 2024 4:1 stock split paid in the form of a stock dividend. The increase in earnings was primarily attributable to higher net interest income driven by continued net interest margin expansion.

Total assets increased year-over-year to $716,771,000 on March 31, 2025 compared to $708,183,000 on March 31, 2024. Total loans of $521,089,000 on March 31, 2025 increased by $1.9 million during the quarter and have increased by $11.9 million (2.3%) over the past twelve months. Total deposits of $619,556,000 on March 31, 2025, decreased $8.6 million during the quarter but have increased $37.8 million (6.5%) over the past twelve months. The Company has focused on balanced growth over the past year with deposit growth providing funding for new loan opportunities. As a result, the Company continues to experience a relatively low reliance on wholesale funding sources and maintains strong levels of available secured borrowing capacity to meet the financing and cash flow needs of our client base as well as continuing to pursue desirable new relationship opportunities.

The Company's net interest margin of 3.65% during the first quarter of 2025 compares favorably with 3.42% in the fourth quarter of 2024 and 3.20% in the first quarter of 2024. Our strong mix of core deposits has allowed the Company to maintain a more stable cost of funds and, combined with a favorable shift in our asset mix, has resulted in the improved net interest margin.

Total shareholders' equity increased to $61,287,000 on March 31, 2025 from $54,053,000 a year ago due primarily to the retained earnings for the past twelve months. For the quarter ended March 31, 2025, the return on average assets and return on average equity was 0.97% and 11.21%, respectively.

The Company did experience an uptick in non-performing loans, increasing from 0.61% of total loans on December 31, 2024 to 0.80% on March 31, 2025, and consisting of one loan which was placed on nonaccrual during the first quarter of 2025. This CRA-eligible multifamily loan, which participates in the DC Housing Voucher Program, has been individually evaluated for specific reserve using recent appraisals. The Company recorded no net charge-offs in either the first quarter of 2025 or 2024, while the allowance for credit losses to total loans increased to 1.19% on March 31, 2025 compared with 1.13% on March 31, 2024.

"We are excited with our positive financial performance in the first quarter of 2025. Our approach to balanced growth has resulted in a meaningful increase to our net interest margin and continually increasing shareholder return," said Jimmy Olevson, President and Chief Executive Officer of the Bank. Olevson continued "While we are encouraged by our positive momentum, we continue to take a cautious approach in light of ongoing economic uncertainties and our reliance on a healthy DC economy. We began to perform reviews of our limited office space commercial real estate portfolio several years ago and continue to do so on a quarterly basis. Additionally, we began in-depth reviews of those borrowers that operate in the government contracting space, to include federal, state, and local levels. We will continue to proactively monitor our entire loan portfolio to help manage risk across all loan types."

The Company also announced today that its Board of Directors has declared a cash dividend of $0.21 per share for shareholders of record as of May 16, 2025. The dividend payout of $241,502.52 on 1,150,012 shares is payable May 30, 2025.

The Board of Directors also approved a share repurchase program in February 2025 of up to $600,000, allowing for purchases from time to time, in open market or private transactions with an expiration date of February 28, 2026. This program replaced the $300,000 share repurchase program approved in 2024. There were no share repurchases during the quarter ended March 31, 2025.

National Capital Bancorp, Inc. is the holding company for The National Capital Bank of Washington which was founded in 1889 and is Washington's Oldest Bank. NCB is headquartered on Capitol Hill with offices in the Friendship Heights community in Northwest D.C., the Courthouse/Clarendon community in Arlington, Virginia and the Fox Hill senior living community of Bethesda, Maryland. NCB also operates residential mortgage and commercial lending offices and a wealth management services division. NCB product and service offerings include personal and business deposit accounts, robust online and mobile banking services and sophisticated treasury management solutions - all delivered with top-rated personal service. NCB is well positioned to serve all the banking needs of those in our communities. For more information about NCB, visit www.nationalcapitalbank.bank.

Forward Looking Statements

This news release may contain certain forward-looking statements, such as statements of the Company's plans, objectives, expectations, estimates and intentions. Forward-looking statements may be identified using words such as "expects," "subject," "will," "intends," "will be" or "would," These statements are subject to change based on various important factors (some of which are beyond the Company's control) and actual results may differ materially. Accordingly, readers should not place undue reliance on any forward-looking statements (which reflect management's analysis of factors only as of the date of which they are given). These factors include general economic conditions, trends in interest rates, the ability of the Company to effectively manage its growth and results of regulatory examinations, among other factors. The foregoing list of important factors is not exclusive.

Contact: Randal J. Rabe, EVP, Chief Financial Officer

Phone: 202-546-8000

Email: [email protected]

SOURCE: National Capital Bancorp, Inc.

View the original press release on ACCESS Newswire

M.Tran--RTC